New fiscal regime for mining sector soon Bawumia

Government will soon introduce a new fiscal regime for the mining sector to ensure Ghana derives maximum benefit from the extraction of her mineral resources, the Vice President Dr. Mamudu

WhatsApp)

WhatsApp)

Government will soon introduce a new fiscal regime for the mining sector to ensure Ghana derives maximum benefit from the extraction of her mineral resources, the Vice President Dr. Mamudu

We often complain the 10% is not enough and Ghana has nothing to show after mining for over 100 year but I will be quick to call for a holistic and comprehensive review of the existing fiscal regime of the industry and application of the royalty payments by the mining 2013, the government made some drastic fiscal regime changes in her policy statement contained in the budget.

1. 0 Introduction The mining sector is one of the major extractive industries in Ghana. It is estimated that the sector contributes about 41% of total export earnings and 5% of Ghanas GDP. The sector is dominant with Foreign Direct Investment (FDI) with little local participation. 1. 1 Legal Framework The Fiscal Regimes that regulate []

It is estimated that the sector contributes about 41% of total export earnings and 5% of Ghana''s GDP The sector is dominant with Foreign Direct Investment (quot;FDIquot;) with little local participation 1 1 Legal Framework The Fiscal Regimes that regulate the sector in Ghana are The Minerals and Mining Act 2006 (Act 703) as amended The . Get Price

The mining sector no doubt plays an important role in the Ghanaian economy. According to Mining Partnership for Development 2015, the sector has attracted more than half of all foreign direct investment (FDI) into Ghana by generating more than onethird of all export revenues as well as being the largest tax paying sector in the country.

Africas mining . regimes: Certainly from the corporate perspective the outcomes of the recent reforms in the mining sector in Africa havePolicy makers must evaluate the appropriate fiscal regime for mining and work to channel rents from mining into the accumulationGold Mining in Ghana, in African Affairs.

Government will soon introduce a new fiscal regime for the mining sector to ensure Ghana derives maximum benefit from the extraction of her mineral resources, the Vice President of the Republic has revealed. The paradigm shift in the thinking behind the utilisation of Ghana rsquo;s mineral resources would seek to ensure value addition to the minerals mined in Ghana instead of the current

#0183;#32;The corporate income tax rate for mining companies in Ghana is 35 percent (for most other sectors it is 25 percent) and mining companies are also required to pay royalties at a basic rate of 5

Government will soon introduce a new fiscal regime for the mining sector to ensure Ghana derives maximum benefit from the extraction of her mineral resources, the Vice President of the Republic has revealed. The paradigm shift in the thinking behind the utilisation of Ghanas mineral resources would seek to ensure value addition to the

The historical importance of mining in the economic development of Ghana is considerable and well documented, with the countrys colonial name Gold Coast reflecting the importance of the mining sector. Gold dominates the mining sector and 1 THE WORLD BANK. 1992, Strategy for African Mining. World Bank Technical Paper, African

The Fiscal Regime of Ghanas Mining Sector. The fiscal regime defines an array of taxes, rents, fees and tax incentives to foreign investors in the mining sector. The quanta of these taxes and incentives have mirrored policy changes in the mining sector since independence.

The mining sector no doubt plays an important role in the Ghanaian economy. According to Mining Partnership for Development 2015, the sector has attracted more than half of all foreign direct investment (FDI) into Ghana by generating more than onethird of all export revenues as well as being the largest tax paying sector in the country.

Fiscal Regime Gross Revenue 60 Royalty 5% Royalty 57 Cost 20 (11 Devt, 9 Prod) Taxable Income Corporate Income Tax 35% AOE Net Revenue (AT NCF) Take Government Share CAPI () 56% (/(6020)) Ghanas Fiscal Regime System Flow Arithmetic

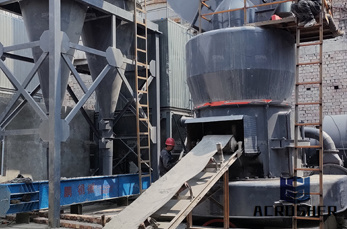

Recent Reforms In Fiscal Regime Of Mining Sector In Ghana . Prompt : Caesar is a famous mining equipment manufacturer wellknown both at home and abroad, major in producing stone crushing equipment, mineral separation equipment, limestone grinding equipment, etc.

Fiscal Regime. Fiscal Regime of Ghana''s Mining Industry And. Revenue projections, including scope for a windfall profit tax. Imposts And Benefits. Provision. Mineral Royalty Rates: Royalty base. 5% Gross

The topic is how to improve fiscal management of mining and petroleum, integrating fiscal regime design, revenue administration, and macrofiscal policy. The novelty of the conference is that it will emphasize how these policy areas are interlinkedweaknesses in one area will undermine progress in othersand need to be addressed in a consistent and comprehensive manner.

WhatsApp)

WhatsApp)